3QFY2019 Result Update | Automobile

February 19, 2019

Ashok Leyland Ltd.

BUY

CMP

`79

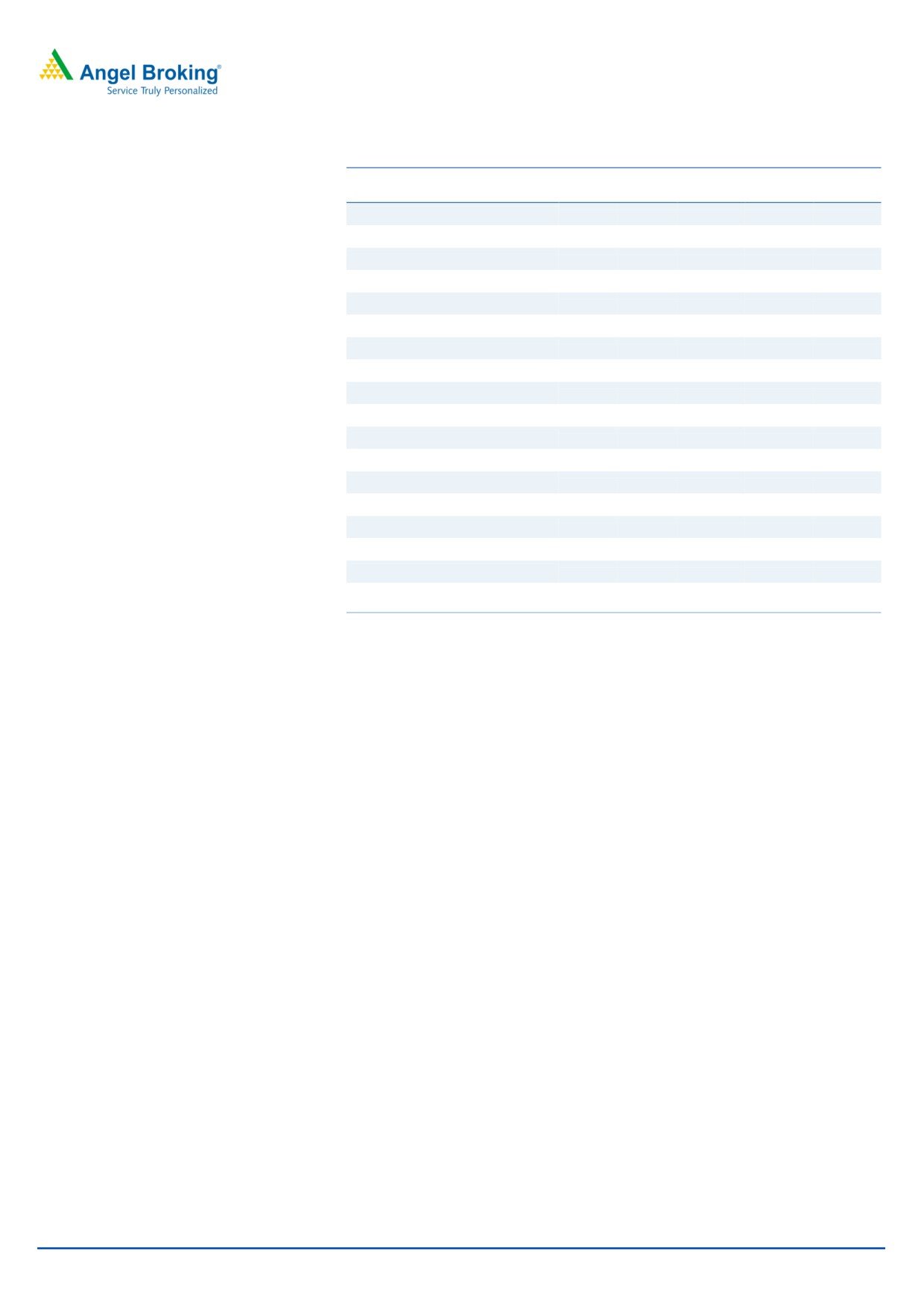

Performance Update

Target Price

`122

(` cr)

3QFY19

3QFY18

% yoy 2QFY19

% qoq

Investment Period

12 months

Revenue

6,325

7,191

(12.0)

7,621

(17.0)

Stock Info

EBITDA

643

569

13.0

810

(20.6)

Sector

Automobile

OPM (%)

10.2

7.9

225bp

10.6

(47bp)

Market Cap (` cr)

31,219

Reported PAT

381

485

(21.5)

528

(27.8)

Net Debt (` cr)

3,739

Source: Company, Angel Research

Beta

1.1

For 3QFY2019, Ashok Leyland Ltd (ALL) posted results, which disappointed on

52 Week High / Low

168/78

both top-line as well as bottom-line fronts. Revenue de-grew by 12% yoy to

Avg. Daily Volume

18,63,726

Face Value (`)

5

`6,325cr. However, operating margin improved by 225bps. On the bottom-line

BSE Sensex

35,498

front, ALL reported PAT de-growth of 21.5% yoy to `381cr on the back of lower

Nifty

10,641

sales.

Reuters Code

ASOK.BO

Subdued top-line performance: The company’s top-line grew by 12% yoy to

Bloomberg Code

AL.IN

`6,325cr mainly due to 6.1% volume decline and 6.3% decline in average

realizations. Despite the strong pick-up in construction, infra-spending and

Shareholding Pattern (%)

mining activities in the country, management expects MHCV volumes to remain

Promoters

51.1

subdued in the next 2-3 quarters. Going forward, FY2020 is expected to be a

MF / Banks / Indian

9.1

FII / NRIs / OCBs

23.7

growth year due to pre-buying before BSVI implementation in India.

Indian Public/Others

16.1

PAT declined despite operating margin improvement: On the operating front, the

company’s margins rose by 225bps yoy to 10.2% due lower other expanses

Abs.(%)

3m

1yr

3yr

(down 397bp yoy). However, PAT de-grew ~22% yoy to `381cr on the back of

Sensex

1.6

4.4

52.0

lower sales.

ALL

(24.7)

(41.7)

(10.6)

Outlook and Valuation: We expect Ashok Leyland to register net profit (reported)

CAGR of ~10% to ~`1,884cr over FY2018-20E mainly due to improvement in

pre-buying sales (owing to introduction of BSVI norms in FY2020) and

replacement demand (implementation of vehicle scrappage policy). Thus, we

recommend BUY on the stock with Target Price of `122.

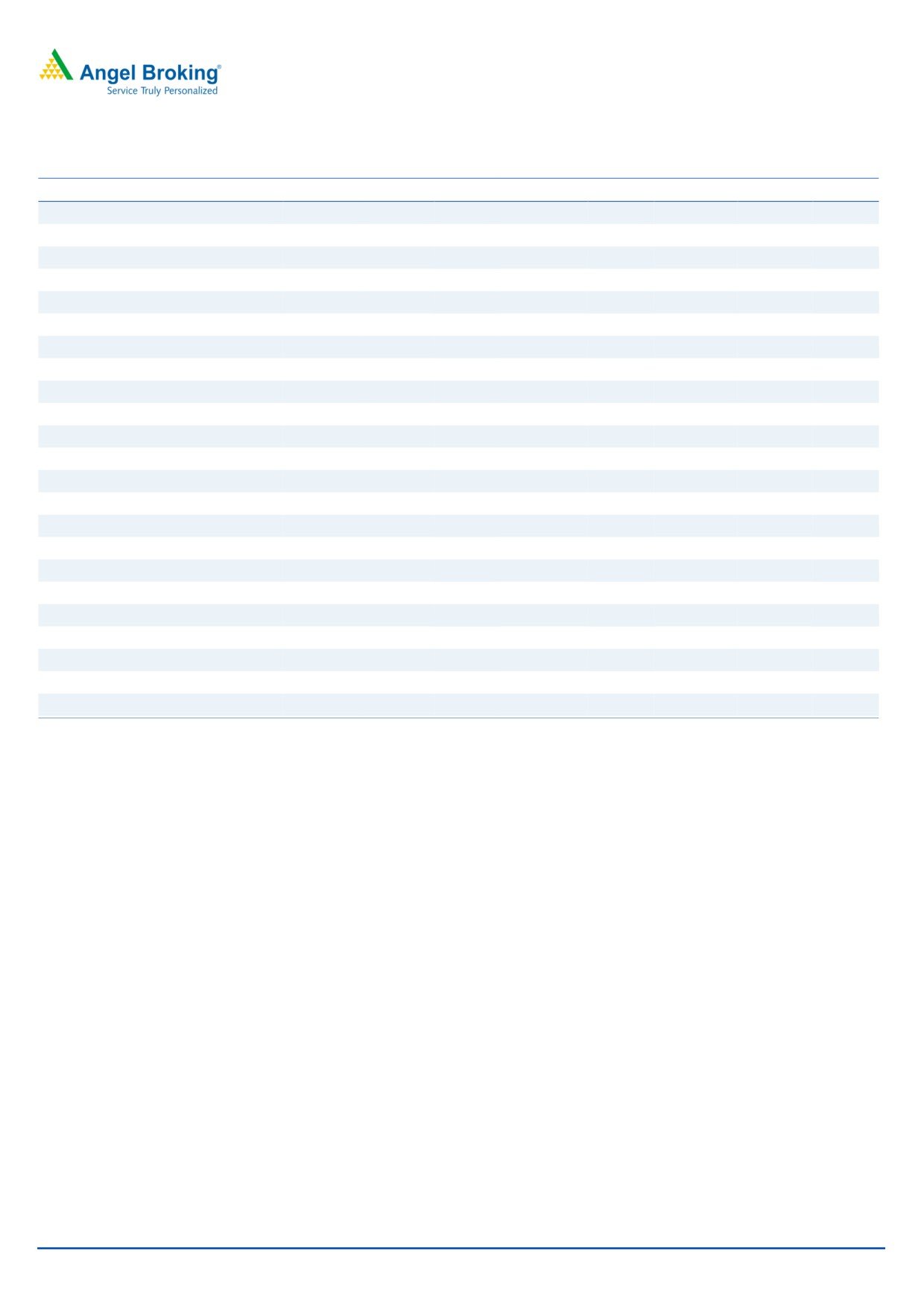

Historical share price chart

Key Financials

180

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

160

140

Net sales

20,019

26,248

28,293

31,122

120

% chg

5.7

31.1

7.8

10.0

100

80

Adj. Net profit

1,491

1,571

1,808

1,884

60

% chg

92.7

5.4

15.0

4.2

40

20

EBITDA margin (%)

8.4

9.4

10.1

10.0

0

EPS (`)

5.1

5.4

6.2

6.4

P/E (x)

15.5

14.7

12.8

12.3

P/BV (x)

3.8

3.2

2.8

2.3

Source: Company, Angel Research

RoE (%)

24.3

22.0

21.5

19.1

RoCE (%)

14.0

23.5

24.5

23.0

Amarjeet S Maurya

EV/Sales (x)

1.1

0.7

0.7

0.6

022-40003600 Ext: 6831

EV/EBITDA (x)

12.8

7.0

6.5

5.7

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Ashok Leyland | 3QFY2019 Result Update

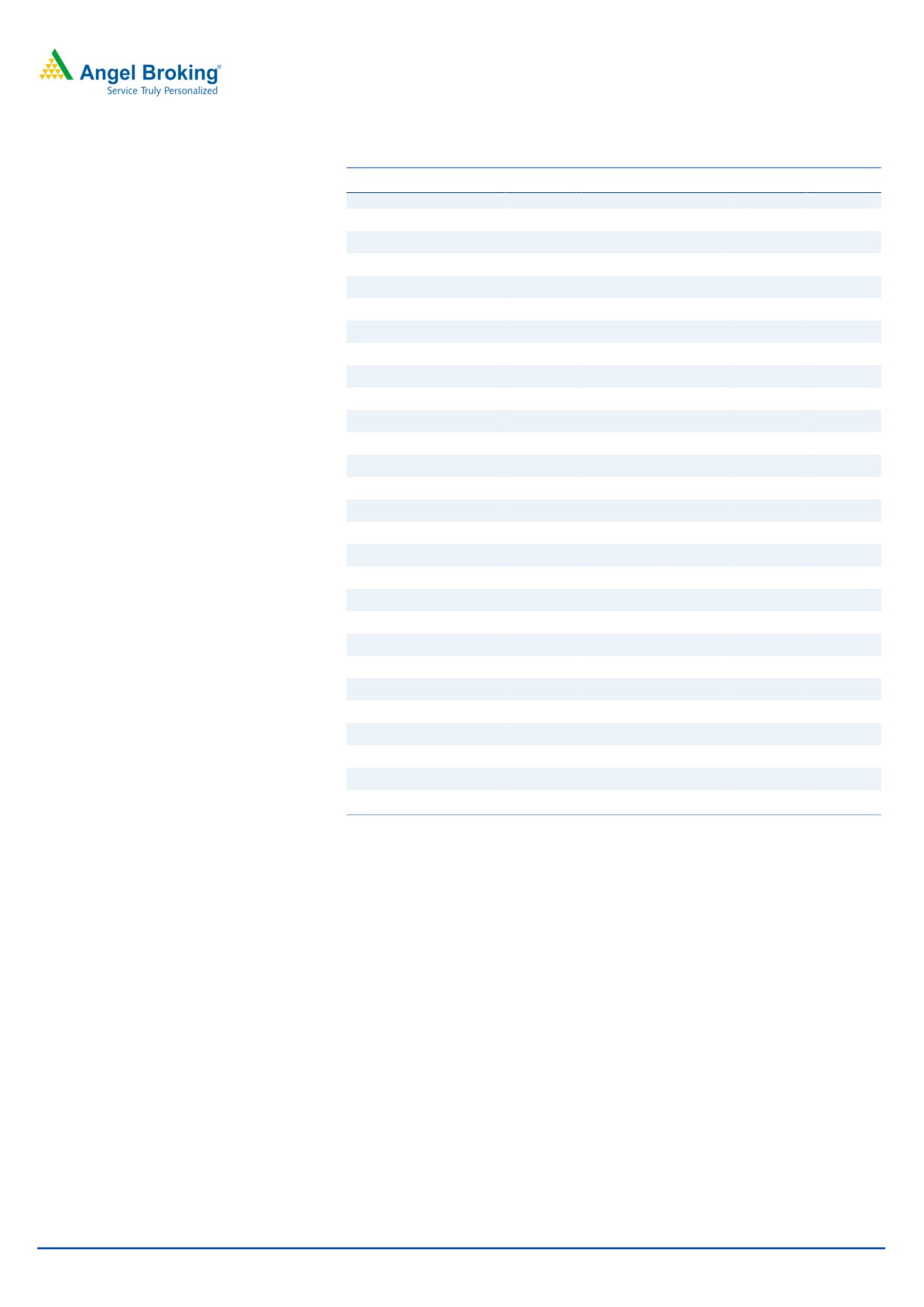

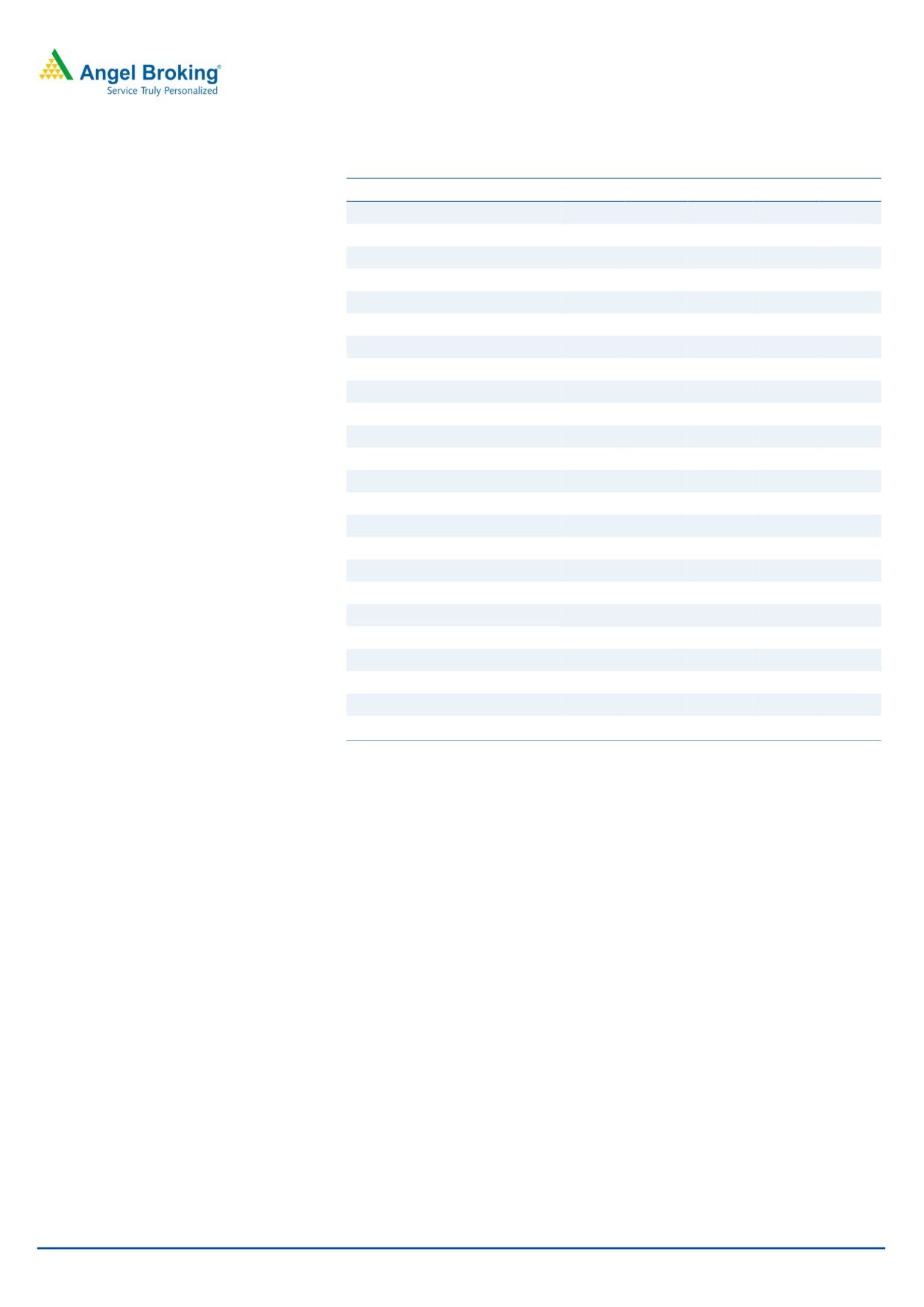

Exhibit 1: 3QFY2019 Performance

Y/E March (` cr)

3QFY19

3QFY18

% yoy

2QFY19

% qoq

9MFY19

9MFY18

% chg

Net Sales

6,325

7,191

(12.0)

7,621

(17.0)

20,209

17,576

15.0

Consumption of RM

4436

5,011

(11.5)

5498

(19.3)

14,250

12,183

17.0

(% of Sales)

70.1

69.7

72.1

70.5

69.3

Staff Costs

500

477

4.9

525

(4.8)

1525.3

1379.0

10.6

(% of Sales)

7.9

6.6

6.9

7.5

7.8

Other Expenses

747

1,135

(34.2)

789

(5.3)

2,331

2,460

(5.2)

(% of Sales)

11.8

15.8

10.3

11.5

14.0

Total Expenditure

5,683

6,622

(14.2)

6,811

(16.6)

18,107

16,022

13.0

Operating Profit

643

569

13.0

810

(20.6)

2,102

1,554

35.2

OPM

10.2

7.9

10.6

10.4

8.8

Interest

19

37

(47.9)

20

(6.1)

54

123

(56.2)

Depreciation

161

146

10.1

148

8.5

461.3

441.1

4.6

Other Income

21

307

(93.2)

30

(29.6)

103

390

(73.5)

PBT (excl. Ext Items)

484

693

(30.2)

671

(27.9)

1,690.30

1,380

22.5

Ext (Income)/Expense

-

-

-

-

-

PBT (incl. Ext Items)

484

693

(30.2)

671

(27.9)

1,690

1,380

22.5

(% of Sales)

7.6

9.6

8.8

8.4

7.9

Provision for Taxation

103

208

(50.6)

143

(28.2)

360

406

(11.2)

(% of PBT)

21.2

30.0

21.3

21.3

29.4

Reported PAT

381

485

(21.5)

528

(27.8)

1,330

975

36.5

PATM

6.0

6.7

6.9

6.6

5.5

Extra-ordinary Items

(5)

(2)

(15)

(34)

(14)

Adjusted Profit After Extra-ordinary item

386

487

(20.8)

543

(29.0)

1,364

988

38.0

Source: Company, Angel Research

February 19, 2019

2

Ashok Leyland | 3QFY2019 Result Update

Outlook and Valuation

We expect Ashok Leyland to register net profit (reported) CAGR of ~10% to

~`1,884cr over FY2018-20E mainly due to improvement in pre-buying sales

(owing to introduction of BSVI norms in FY2020) and replacement demand

(implementation of vehicle scrappage policy). Thus, we recommend BUY on the

stock with Target Price of `122.

Downside risks to our estimates

Slowdown in industrial activities could restrict sales volume for ALL.

Delay in implementation of vehicle scrappage policy could restrict the

additional sales growth for company.

Company Background

Ashok Leyland Ltd (ALL) is a holding company. The company is engaged in

commercial vehicles and related components. Through its subsidiaries, it is

engaged in manufacturing and trading in Medium and Heavy Commercial Vehicle

(MHCV), Light Commercial Vehicles (LCV), Passenger Vehicles (PV), automotive

aggregates, vehicle financing and engineering design services. It offers a range of

18 to 80 seater buses under categories such as city application and electric buses.

It offers a range of trucks, which includes long haul trucks, mining and construction

trucks, and distribution trucks. It designs, develops and manufactures defence

vehicles for armed forces. It offers Light Vehicles, which includes DOST, PARTNER,

STiLE and MiTR. It offers power solutions for electric power generation, agricultural

harvester combines, earth moving and construction equipment and marine and

other non-automotive applications. It has operations in India, Sri Lanka,

Bangladesh, Mauritius, the Middle East and Africa.

February 19, 2019

3

Ashok Leyland | 3QFY2019 Result Update

Standalone Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Net Sales

18,937

20,019

26,248

28,293

31,122

% chg

39.6

5.7

31.1

7.8

10.0

Total Expenditure

17,498

18,341

23,774

25,435

28,010

Raw Material

13,195

13,973

18,621

20,229

22,252

Personnel

1,385

1,543

1,812

2,320

2,552

Others Expenses

2,918

2,825

3,341

2,886

3,206

EBITDA

1,439

1,677

2,474

2,858

3,112

% chg

79.4

16.5

47.5

15.5

8.9

(% of Net Sales)

7.6

8.4

9.4

10.1

10.0

Depreciation& Amortisation

488

518

555

624

680

EBIT

952

1,160

1,919

2,234

2,433

% chg

146.4

21.9

65.5

16.4

8.9

(% of Net Sales)

5.0

5.8

7.3

7.9

7.8

Interest & other Charges

248

155

131

73

61

Other Income

123

326

443

125

140

(% of PBT)

14.8

24.5

19.8

5.5

5.6

Recurring PBT

827

1,330

2,231

2,286

2,512

% chg

86.9

60.9

67.7

2.5

9.9

Tax

437

107

668

503

628

(% of PBT)

52.9

8.0

30.0

22.0

25.0

PAT (reported)

390

1,223

1,563

1,783

1,884

Extraordinary Items

(384)

(268)

(9)

(25)

-

ADJ. PAT

774

1,491

1,571

1,808

1,884

% chg

199.5

92.7

5.4

15.0

4.2

(% of Net Sales)

4.1

7.4

6.0

6.4

6.1

Basic EPS (`)

2.6

5.1

5.4

6.2

6.4

Fully Diluted EPS (`)

2.6

5.1

5.4

6.2

6.4

% chg

199.5

92.7

5.4

15.0

4.2

February 19, 2019

4

Ashok Leyland | 3QFY2019 Result Update

Standalone Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

285

285

293

293

293

Reserves& Surplus

5,123

5,841

6,861

8,107

9,590

Shareholders Funds

5,407

6,126

7,154

8,400

9,882

Total Loans

2,415

2,145

1,002

700

700

Deferred Tax Liability

753

741

726

726

726

Total Liabilities

8,575

9,012

8,882

9,826

11,308

APPLICATION OF FUNDS

Gross Block

5,279

5,858

6,312

6,958

7,658

Less: Acc. Depreciation

487

887

1,338

1,962

2,641

Net Block

4,792

4,971

4,974

4,996

5,017

Capital Work-in-Progress

76

206

401

401

401

Investments

1,980

2,879

5,803

2,774

2,774

Current Assets

5,925

5,744

5,408

9,332

11,591

Inventories

1,625

2,501

1,710

2,558

3,070

Sundry Debtors

1,251

860

980

1,705

2,046

Cash

1,593

912

1,004

2,381

3,207

Loans & Advances

712

709

1,120

1,415

1,712

Other Assets

745

762

593

1,273

1,556

Current liabilities

4,623

5,402

8,131

7,748

8,469

Net Current Assets

1,303

342

(2,723)

1,584

3,122

Deferred Tax Asset

424

614

427

427

427

Mis. Exp. not written off

-

-

-

-

-

Total Assets

8,575

9,012

8,882

9,826

11,308

February 19, 2019

5

Ashok Leyland | 3QFY2019 Result Update

Standalone Cashflow Statement

Y/E March (Rs cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

Profit before tax

390

1223

1563

2286

2512

Depreciation

488

518

555

624

680

Change in Working Capital

(179)

190

2962

(2931)

(712)

Interest / Dividend (Net)

203

88

77

0

0

Direct taxes paid

(441)

(348)

(415)

(503)

(628)

Others

1223

484

677

0

0

Cash Flow from Operations

1683

2155

5418

(524)

1851

(Inc.)/ Dec. in Fixed Assets

34

(366)

(532)

(500)

(700)

(Inc.)/ Dec. in Investments

330

(1111)

(2800)

3028

0

Cash Flow from Investing

364

(1477)

(3332)

2528

(700)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

(789)

(883)

(1270)

(302)

0

Dividend Paid (Incl. Tax)

(154)

(325)

(549)

(325)

(325)

Interest / Dividend (Net)

(263)

(151)

(175)

0

0

Cash Flow from Financing

(1205)

(1359)

(1994)

(628)

(325)

Inc./(Dec.) in Cash

842

(681)

92

1377

826

Opening Cash balances

751

1593

912

1004

2381

Closing Cash balances

1593

912

1004

2381

3207

February 19, 2019

6

Ashok Leyland | 3QFY2019 Result Update

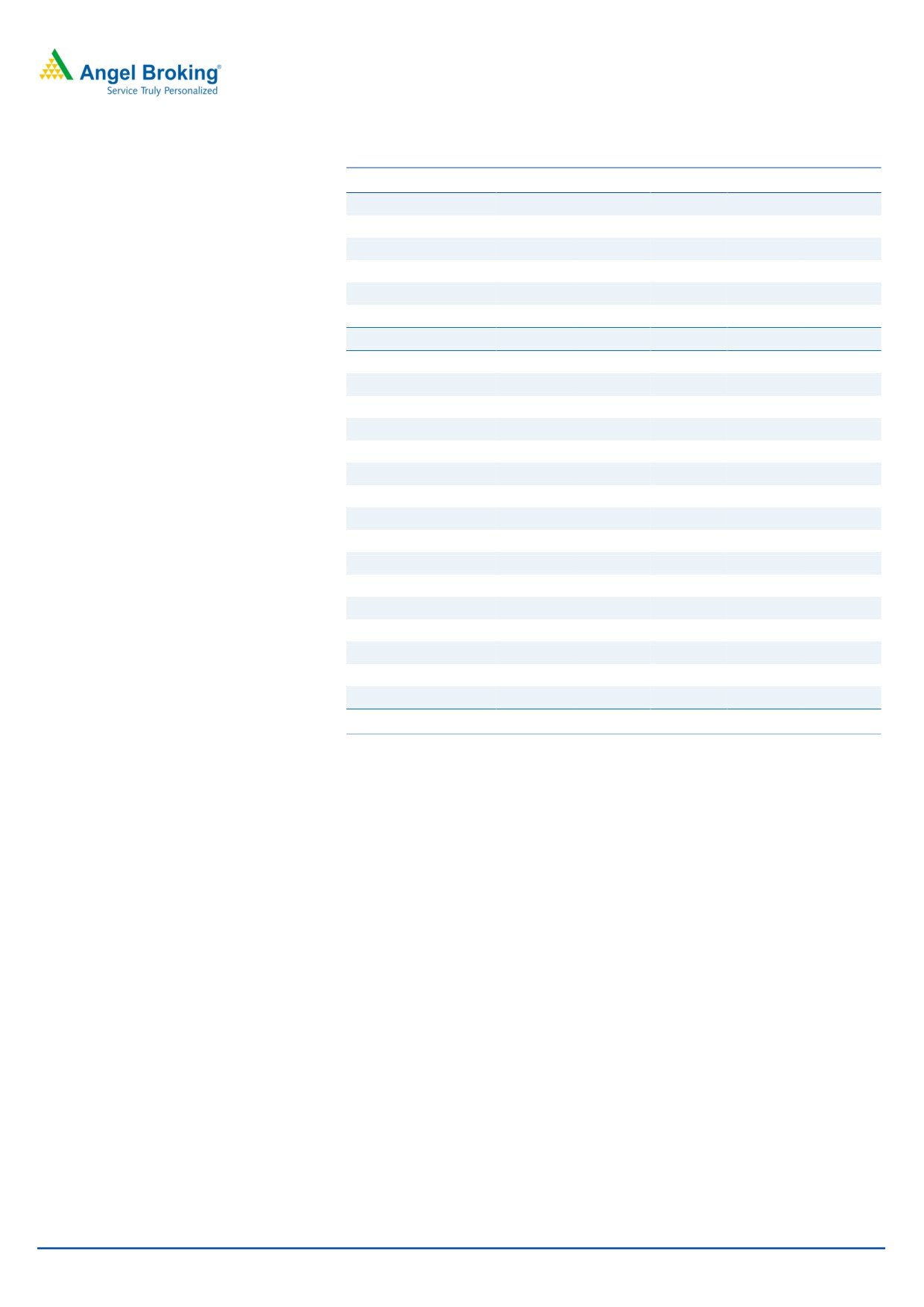

Exhibit 2:

Y/E March

FY2016

FY2017

FY2018

FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

29.9

15.5

14.7

12.8

12.3

P/CEPS

26.4

13.3

10.9

9.6

9.0

P/BV

4.3

3.8

3.2

2.8

2.3

Dividend yield (%)

0.7

1.4

0.0

0.0

0.0

EV/Sales

1.2

1.1

0.7

0.7

0.6

EV/EBITDA

15.3

12.8

7.0

6.5

5.7

EV / Total Assets

2.6

2.4

1.9

1.8

1.5

Per Share Data (Rs)

EPS (Basic)

2.6

5.1

5.4

6.2

6.4

EPS (fully diluted)

2.6

5.1

5.4

6.2

6.4

Cash EPS

3.0

5.9

7.2

8.2

8.8

DPS

0.5

1.1

0.0

0.0

0.0

Book Value

18.5

20.9

24.4

28.7

33.8

Returns (%)

ROCE

12.2

14.0

23.5

24.5

23.0

Angel ROIC (Pre-tax)

22.4

25.9

142.2

56.6

52.9

ROE

14.3

24.3

22.0

21.5

19.1

Turnover ratios (x)

Asset Turnover (Gross Block)

3.6

3.4

4.2

4.1

4.1

Inventory / Sales (days)

31

46

24

33

36

Receivables (days)

24

16

14

22

24

Payables (days)

50

56

66

60

60

Working capital cycle (ex-cash) (days)

6

5

(29)

(5)

-

Source: Company, Angel Research

February 19, 2019

7

Ashok Leyland | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Ashok Leyland

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

February 19, 2019

8